Concert Infrastructure by the Numbers

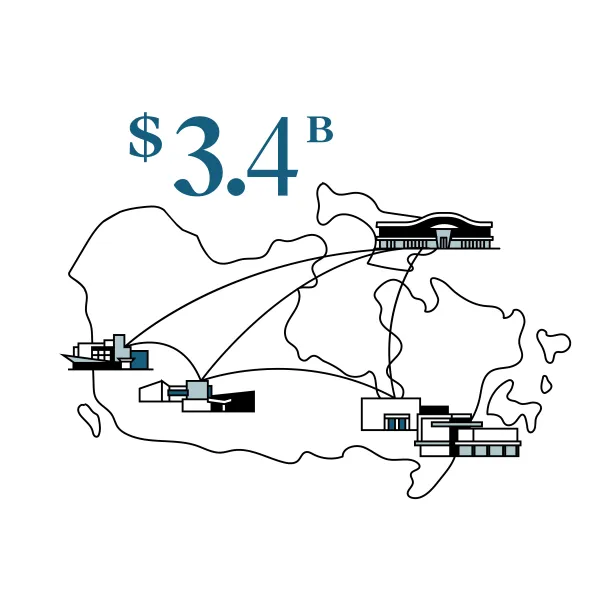

AGGREGATE PORTFOLIO CAPITALIZATION OF MORE THAN $3.4 BILLION

DIRECT INVESTMENT AND MANAGEMENT OF 10 CANADIAN PUBLIC-PRIVATE PARTNERSHIP PROJECTS

OWNED BY 10 CANADIAN UNION AND MANAGEMENT PENSION PLANS

14 YEARS OF DIRECT INFRASTRUCTURE INVESTMENT AND MANAGEMENT

The Concert Infrastructure Team

Our team brings strength and a depth of experience in investing in, delivering and managing critical Canadian infrastructure projects. Above all, we pride ourselves in understanding and supporting government public policy objectives beyond just the infrastructure that we deliver and on the strong, long term relationships we forge with our industry and government partners. Concert’s core values of integrity, service and quality drive our team’s business approach.

Derron Bain, Chief Executive Officer

Joining Concert Infrastructure at its inception in 2010, Derron leads the strategy, investment, financing and asset management activities of the Concert Infrastructure Fund, reporting to its Board of Directors. He holds lead directorships in each of Concert Infrastructure’s projects.

Over a twenty three-year period, Derron has successfully led the planning, financing, delivery and management of complex public private partnership infrastructure projects with a cumulative capital value of over $12 billion. Before joining Concert Infrastructure, Derron was a founding team member of a Crown corporation created to build, finance and enhance public infrastructure in Ontario. With this experience he has a unique perspective and understanding of the intersection between government infrastructure policy and the private sector.

A graduate of the Royal Military College of Canada and Dalhousie University, prior to his career in infrastructure, Derron was a maritime warfare officer in the Royal Canadian Navy. Committed to supporting Veterans, in 2023 he participated in the True Patriot Love Foundation’s expedition in tribute to the joint Canada-US Devil’s Brigade. This initiative honours the over 2,000 lives lost in World War II, while creating awareness and raising funds to support the physical and mental wellness of members of the Canadian Armed Forces, Veterans and their families.

Ian Podmore

Group Head, Development and Construction

Ian Podmore is the Group Head Development and Construction of Concert Infrastructure. In this capacity he leads partnering, bidding and construction oversight activities of Concert Infrastructure’s projects.

He has over 17 years of development and infrastructure project delivery experience. Prior to joining Concert Infrastructure at its inception in 2010, Ian was a member of the Concert Properties' development team.

Ian is a graduate of the University of Victoria.

Robert Azzam

Group Head, Finance

Robert Azzam is the Group Head Finance of Concert Infrastructure. In this capacity he leads the project financing and financial administration activities of Concert Infrastructure and its projects.

He has over 25 years of financing experience. Prior to joining Concert Infrastructure in 2016, Robert held senior roles with Toronto-Dominion Bank and Infrastructure Ontario.

Robert is a graduate of Concordia University and holds an MBA in Finance from McGill University.

Amber Pleasance

Group Head, Project Operations Management

Amber Pleasance is the Group Head Project Operations Management of Concert Infrastructure. In this capacity she leads the oversight and management of Concert Infrastructure’s operational projects.

She has over 15 years of infrastructure project administration and management experience. Prior to joining Concert Infrastructure in 2014, Amber was a member of the project delivery team at Infrastructure Ontario.

Amber is a graduate of the University of Toronto.

Our Board of Directors

The Concert Infrastructure Board of Directors is elected annually from representatives nominated by the union and management pension plans they represent.

Ivan Limpright

ChairDavid Podmore, OBC

Co-Founder, Chair EmeritusDarcy Biln

Trustee Local 213 Electrical Workers' Pension PlanDan Jarvis

Business ExecutiveCzardoz Loquia

Trustee Telecommunication Workers Pension Plan (TWPP)Vincent Lukacs

Trustee, Pulp & Paper Industry Pension Plan National Representative, UniforRichard Short

Trustee Pulp & Paper Industry Pension PlanBryan Wall

Trustee United Food and Commercial Workers Union Pension PlanDavid Lawson

Trustee Telecommunications Workers Pension Plan (TWPP)Bryan Railton

Trustee and Chair Operating Engineers’ Pension PlanOur Company Unitholders

Concert is exclusively owned by more than 200,000 Canadian workers, represented by union and management pension funds, who keep us focused on generating steady, long-term value through our infrastructure projects.

Telecommunication Workers Pension Plan

Pulp & Paper Industry Pension Plan

UFCW Union Pension Plan

Teamsters (Local 213) Pension Plan

Local 213 Electrical Workers Pension Plan

Operating Engineer’s Pension Plan

Plumbing and Pipefitting Workers Local 170 Pension Plan

Pile Drivers’, Divers, Bridge, Dock & Wharf Builders’ Pension Plan

Marine and Shipbuilders Local 506 Pension Plan

British Columbia Labourers' Pension Plan

Community Involvement

Concert Infrastructure works in close support of the Concert Communities Works initiative.

At Concert we are deeply invested in improving the lives of the Canadians in the communities where we partner to deliver and manage critical public infrastructure. This philosophy extends to a corporate giving program, investment in trades training programs and other philanthropic endeavors, donating staff time—as well as money and resources—to socially conscious community projects.

Sustainability

Concert Infrastructure prioritizes environmental, social and economic sustainability principles across our business, and our investment portfolio delivers innovative design and system solutions that support Leadership in Energy and Environmental Design (LEED) Certification, energy performance targets and guarantees, BOMA Best Certification and green financing.

At its core, Concert Infrastructure is focused on investing, developing and managing infrastructure that supports the long-term needs of communities across Canada, and is committed to the Principles of Responsible Investment (PRI) Reporting Framework. PRI is a United Nations supported network of investors who work together to promote sustainable investment through the implementation of six aspirational environmental, social and governance principles.

Supported by strong corporate governance and values, Concert Infrastructure invests, develops and manages sustainable infrastructure assets in communities across Canada. As a signatory to PRI since 2021, Concert Infrastructure is proud and committed to upholding the following six Principles for Responsible Investment.

PRINCIPLE ONE

We will incorporate ESG issues into investment analysis and decision-making processes.

PRINCIPLE TWO

We will be active owners and incorporate ESG issues into our ownership policies and practices.

PRINCIPLE THREE

We will seek appropriate disclosure on ESG issues by the entities in which we invest.

PRINCIPLE FOUR

We will promote acceptance and implementation of the Principles within the investment industry.

PRINCIPLE FIVE

We will work together to enhance our effectiveness in implementing the Principles.

PRINCIPLE SIX

We will each report on our activities and progress towards implementing the Principles.

2024 Responsible Investing Report

Our first-ever Responsible Investing Report outlines Concert Infrastructure's formalized approach to responsible investing and commitment to environmental, social and economic sustainability across our entire investment portfolio.